Summary:

We’re in the middle of humanity’s greatest energy transition. The defining problem of our generation is shifting 80% of the world’s energy production from fossil-based systems to clean ones while removing existing carbon dioxide from our air and oceans.

Despite Europe consistently leading the way, it looks like corporate America is ready to take the climate spotlight. Earlier this year, the SEC proposed landmark legislation which would require all publicly traded companies to disclose climate-related risks. This includes listing all greenhouse gas emissions and plans to tackle them.

Historically, working in climate was considered concessionary do-gooderism that didn’t make real money. Corporate behavioral shifts and technological progress means this is now an opportunity for capitalists.

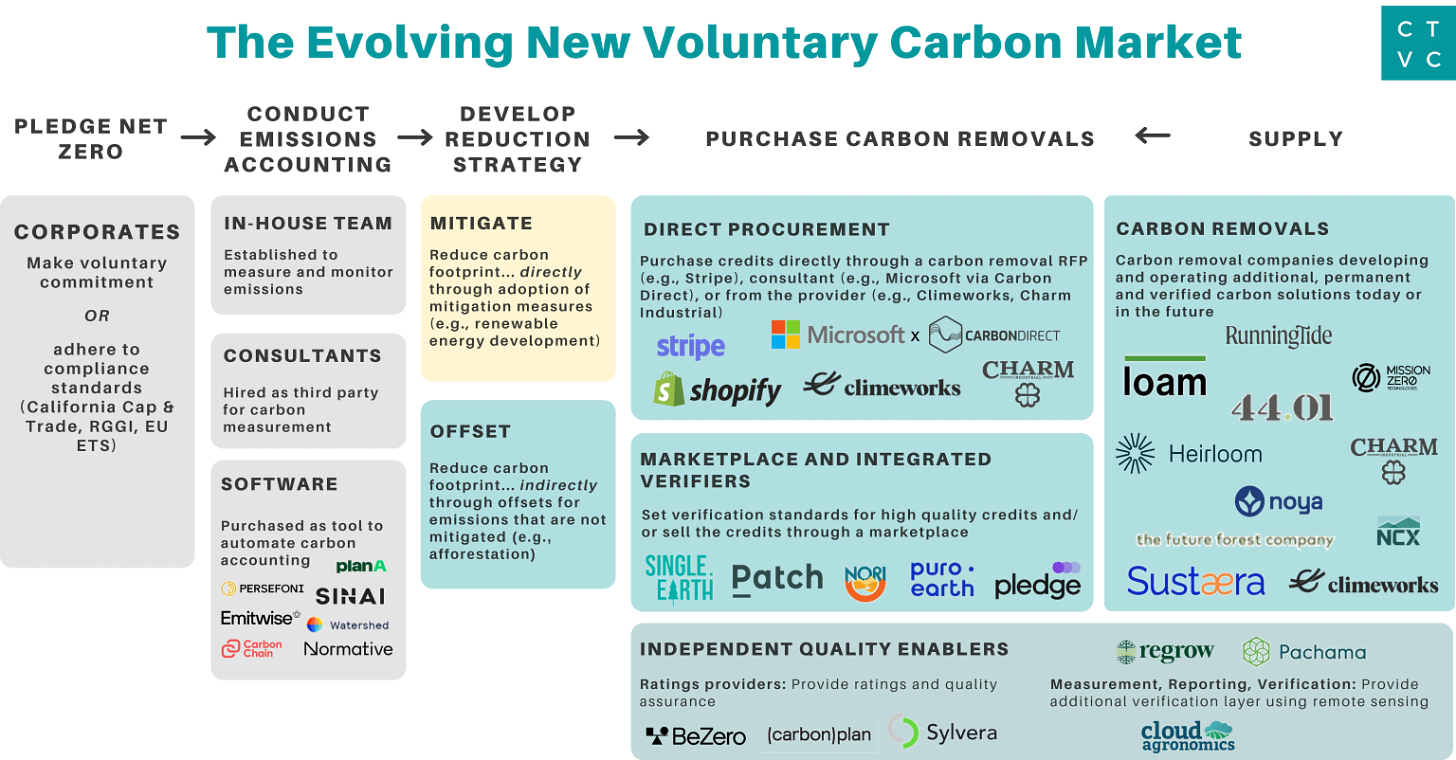

One of the most promising areas for startups is serving the voluntary carbon markets. The market exists to help companies track, reduce and offset emissions. Over the past five years, the market grew >15x, with 100-fold growth anticipated between 2020 and 2050, reaching up to $180 billion by 2030.

Voluntary markets co-exist with compliance markets which regulate entities to meet targets like California’s Cap and Trade program. Compliance markets are bigger but navigating government specifications is challenging.

Below is a primer for technology founders and investors to learn about voluntary carbon markets, carbon offsets and opportunities for carbon removal startups. No scientific or finance background required.

We’re at an inflection point in decarbonisation – growing interest, capital and talent are flooding the space. For startups, it’s a unique opportunity to win large amounts of corporate dollars. Voluntary markets also serve as a promising on-ramp to build products and services that could later serve the compliance market.

This is an evolving market and the post may contain errors, large or small. If you find one, let me know and I’ll pay $10. Thoughts and feedback welcome on Twitter or Email.

Why do voluntary carbon markets exist and what do they do?

Many of the world’s most influential companies are pledging to reach net-zero emissions in the next decade. Microsoft, Amazon, Delta, Shopify and 622 out of 2,000 of the world’s publicly traded companies have all made commitments. Achieving net zero emissions means releasing some greenhouse emissions but offsetting these emissions by removing an equivalent amount.

Despite being ‘voluntary’, net zero emissions targets are now becoming effectively mandatory for a company to be taken seriously on sustainability, especially to an increasingly climate conscious workforce. Alongside looming regulation, investors are threatening to pull money out of companies, or in the case of Exxon, elect new board members who are more aggressive on climate action.

Currently there’s a significant number of startups building in the carbon accounting space like Watershed, Patch and Persefoni. Once a company establishes a baseline target around emissions, they focus on reducing and offsetting emissions. Reducing emissions should be a priority however, in some cases, like air travel, they are unable to find climate-friendly options.

Carbon Offsets:

Offsetting involves directing financing to climate projects that can avoid or remove greenhouse gas emissions. A voluntary carbon market allows a company, say Stripe, to purchase a carbon offset for tons of carbon removed or mitigated by a seller. As corporations gain accurate emissions numbers, the demand for carbon offsets is increasing.

Currently, corporate players are purchasing offsets in the VCMs that meet or exceed analogous mandates in compliance markets.

Finding verified high-quality offsets is a challenge. Here’s the next opportunity for startups.

Monitoring, Reporting and Verification:

Bringing trust to voluntary carbon markets is critical. Historically these markets have lacked transparency around the quality of carbon projects, leaving corporate buyers unsure of what they are purchasing.

Carbon offset registries are systems for reporting and tracking offset project information including issuing carbon offsets, ownership, sale, and retirement.

Existing registries, like Verra, have failed to prevent offset scams. This year, one of the largest sellers of offsets recently announced selling $70M of fake offsets despite receiving verification.

Tech-enabled independent verifiers are emerging like Sylvera and BeZero to provide accurate and trustworthy carbon project data and ratings. These companies are essentially ‘auditing’ the work of existing players (Gold Standard, Verra and CAR).

We’re also seeing venture money pour into Web3, blockchain and regenerative finance projects that claim to tackle trust and liquidity in the market. Take for example FlowCarbon which recently raised $70M to “bring carbon credits onto the blockchain”. It’s unclear how putting offsets on a distributed ledger is functionally additive to the central challenge of scaling carbon markets - assessing the quality of the offsets to avoid or sequester carbon emissions.

Another crypto effort, Toucan Protocol, spent millions of dollars on low quality avoidance offsets generating demand for zombie projects. Existing registries are responding quickly - Verra said it is stopping the practice of creating blockchain tokens or instruments based on retired credits.

There’s a real danger that these companies serve as gateways for more fraudulent projects that exist currently in incumbent registries. As the market develops, we’ll gain better insights on how they will manage this risk.

Unlocking high-quality supply:

As outlined above, there are a lot of software startups in climate tech focusing on accounting and verification. As verification solutions build a new trust layer for carbon offsets, the next opportunity for climate startups will be focused on unlocking carbon removal supply - either taking commercial mature technologies and scaling them or investing in deep tech solutions to build new ones.

Demand for offsets is growing quickly but not all offsets are created equal. There are two types of offsets: avoidance and removal. Each offset represents a ton of carbon dioxide that has been either directly removed from the atmosphere or avoided through a certified project.

Avoidance offsets focus on reducing emissions by preventing their release into the atmosphere (for example limiting timber harvest levels).

Removal offsets focus on taking carbon out of the atmosphere (e.g., through methods like direct air capture).

Avoidance offsets: Criticism continues to mount against the effectiveness of certain avoidance offsets. For example, The Nature Conservancy made $2M from offsets for claiming they wouldn’t log the Hawk Mountain Sanctuary Association’s 2380 acre of Pennsylvania forest. But the forest was already a conservancy, meaning it would never be logged. Many of the problems with avoidance offsets are the fact they are attempting to value a counterfactual, whereas removal offsets are measuring reality directly.

The case for removal offsets:

Most scientific models estimate that we have to permanently remove huge amounts of CO2 already in the atmosphere — five to ten billion tonnes per year by 2050. To put that in context, we currently have less than 10 thousand tons of CO2 permanently removed.

We’re now seeing more companies turn their attention to carbon removal offsets where, in many cases, it’s far easier to determine effectiveness. Last September, Microsoft co-wrote an article in Nature, explicitly arguing against buying avoidance offsets and in favor of removal offsets:

“By paying someone else not to emit as a way to compensate for ongoing emissions is not as effective as the other kind of offsetting – emissions removal. That is because carbon offsetting can slow the rate at which CO2 builds up in the atmosphere, but it does not remove any.

That’s why, in 2020, Microsoft pivoted to purchasing only carbon removal”

More recently, a coalition of forward-thinking tech companies, including Stripe, Shopify and Microsoft even kickstarted a $1 billion advanced market commitment for carbon removal technologies.

We need more removal offsets. The problem is finding supply.

What are the current offerings for removal offsets?

In the removal offsets space, there are a lot of options, such as planting trees or soil carbon sequestration, but there are very few which permanently remove carbon dioxide from the atmosphere without fear that it will be re-released.

One of the reasons we have so few removal offset options is that it wasn’t clear anyone would pay for scalable removal. New technologies are expensive to develop, only becoming cheaper through scale. And with cheaper options for corporate and governments to buy to fulfill their net-zero commitments, more expensive solutions are far less attractive. The price of removal offsets varies widely ranging from $1 per ton to $600 per ton which is largely a function of the maturity of the technology used to sequester carbon.

We have two options - scaling up existing methods and investing in R&D. Currently there is no cost-efficient and scalable method to remove gigatons of carbon dioxide, the hope is that investing heavily in R&D will produce something but, in the interim, continue scaling up all the existing methods at our disposal.

While R&D work continues to develop new technologies, it’s highly unlikely the majority of cost-conscious corporate buyers will exclusively want to fund frontier, expensive and, yet to be proven, technology. At the same time, however, scrutiny on the voluntary market increases, including possible regulation, money spent on cheap and ineffective carbon offsets will lessen.

With many different CDR options available and no clear winner, it is likely that corporate buyers will seek a portfolio approach to buying carbon offsets. And we’re already seeing Microsoft lead the way.

As it stands, there are roughly six ‘product’ offerings for corporate buyers.

The cheapest option, reforestation and afforestation, are under fire, specifically regarding their effectiveness and reliability. In 2019, a ProPublica report discovered multiple examples of programs that sold carbon offsets for work that never ended up happening. There’s also been numerous examples of forests used as carbon offsets projects going up in flames. When trees burn down, they release carbon dioxide into the atmosphere.

This leaves us with more permanent and costly methods – biochar, enhanced weathering, direct air capture (DAC), bio-oil injection and bioenergy with carbon capture and storage (BECCS). For a deep dive into these methods, I recommend reading this primer.

We don’t have enough removal offsets – opportunities for startups

Existing product offerings:

Biochar

One of the most promising areas is taking relatively mature technologies but commercially immature, such as biochar, and rapidly scaling up production rapidly.

(Credit: Soil Biochar)

Biochar is a charcoal-like product that is created by heating biomass to very high temperatures in a low-oxygen environment. Pyrolysis converts carbon in biomass to a form that resists decay, by heating organic material, such as biomass, in the absence of oxygen. When the charcoal is buried or added to soils, most of the carbon can remain in the charcoal or soil for centuries, given the right conditions. Burying the biochar can keep the carbon out of the atmosphere for long periods of time. This makes producing and burying biochar a form of carbon removal.

Biochar is ramping up in popularity with early corporate buyers. Of all removal purchases last year, biochar made up 45% of publicly available spend. One of the reasons for biochar’s popularity is likely its price point and effectiveness in the removal camp. Biochar is substantially more expensive than avoidance based offset but in comparison to more expensive removal methods, like DAC which cost ~$600 ton, biochar at ~$100 ton is cheap.

There are challenges to ramping up biochar - ensuring additionality (reductions would not have happened unless an offset was bought) and permanence (reductions can’t be reversed) is key but these are known and solvable problems.

Bio-energy with carbon capture and storage (BECCS)

Credit: National Energy Technology Laboratory

BECCS is a removal method that depends on two processes. Biomass is converted into electricity or liquid or gas fuels (creating bioenergy), and the carbon emissions from the bioenergy conversion are captured and stored in the ground or durable products (storing the carbon). Charm Industrial is leading the space, converting agricultural biomass into bio-oil and safely injecting it into the ground. BECCs produces carbon-negative fuels, which could potentially be used for hard-to-decarbonize sectors like steel. The challenge is ensuring that emissions from growing, harvesting, transporting and processing the biomass do not cancel out the emissions captured and stored.

Direct Air Capture

Credit: Carbon Engineering

Direct Air Capture (DAC) is a technology that uses chemical reactions to pull carbon dioxide out of the air. Current direct air capture facilities like Climeworks and Carbon Engineering, pass air through a sorbent, which are composed of common chemicals. When air moves over these chemicals, they selectively react and tap CO2, allowing the other components of air to pass through. The result of DAC is pure gaseous CO2, which can be sequestered or utilized.

DAC, bio-oil and other solutions also hold promise but currently they are currently extremely early and very expensive. It’s likely these solutions will take years to be cost effective at scale. DAC and bio-oil sequestration with storage are currently the most expensive options for corporate buyers but they are also the most permanent removal methods (storing CO2 for over 1000 years). The bet is that the costs of these technologies will drop dramatically over time (~$100 per ton).

New product offerings:

Carbon Mineralization

This removal method exploits a natural process wherein reactive materials like peridotite or basaltic lava chemically bond with CO2, forming solid carbonate minerals such as limestone that can store CO2 for millions of years. The reactive materials can be combined with CO2-bearing fluid at carbon capture stations, or the fluid can be pumped into reactive rock formations where they naturally occur.

Because carbon mineralization takes advantage of natural chemical processes, it has the potential to provide an economical, non-toxic and permanent way to store huge amounts of carbon. However, there are still technical and environmental questions that need to be answered—according to the National Academies report, carbon mineralization could possibly contaminate water resources or trigger earthquakes.

Blue Carbon

Salt marshes, mangroves, sea grasses and other plants in tidal wetlands are responsible for more than half of the carbon sequestered in the ocean and coastal ecosystems. This blue carbon can be stored for millennia in the plants and sediments. However, wetlands are being destroyed by runoff and pollution, drought and coastal development. Restoring and creating wetlands and managing them better could potentially double carbon storage. Healthy wetlands also provide storm protection, improve water quality and support marine life.

Enhanced weathering

Rocks and soil become weathered by reacting with CO2 in the air or in acid rain, which naturally occurs when CO2 in air dissolves in rainwater. The rocks break down, creating bicarbonate, a carbon sink, which is eventually carried into the ocean where it is stored. Enhanced weathering speeds up this process by spreading pulverized rock, such as basalt or olivine, on agricultural land or on the ocean. It could be crushed and spread on fields and beaches, and even used for paths and playgrounds.

Ocean alkalinization involves adding alkaline minerals, such as olivine, to the ocean surface to increase CO2 uptake and counteract ocean acidification. One study estimated that this strategy could sequester between 100 metric tons to 10 gigatonnes of CO2 a year, for costs ranging from $14 to over $500 a ton. Although ecological impacts are unknown.

We need more options:

More offsets methods, like biochar, that lie at the intersection of ‘nature’ and ‘tech based’ solutions are also emerging, including large scale kelp-farming and crushing up gigantic slabs of rock. These may unlock the key to removing billions gigatonnes of carbon from our atmosphere.

Y Combinator recently released a post looking for new types of carbon dioxide removal technologies, none of which have yet been tested outside of a lab. Specifically, they are looking for projects in four areas:

Modifying the genes of phytoplankton would enable them to sequester carbon in areas of the global ocean that lack the nutrients needed for photosynthesis.

Electro-geo-chemistry uses electricity from renewable sources to break saline water down to produce hydrogen (which can be used for fuel) and oxygen, which, in the presence of minerals, produces a highly reactive solution. This solution absorbs carbon dioxide from the atmosphere and turns it into bicarbonate.

Enzyme systems speed up chemical reactions that could change carbon dioxide into other useful organic compounds. Y Combinator would like to create enzyme systems that can do this outside of living cells to simplify carbon fixation.

The last idea involves creating 4.5 million little oases in deserts to host phytoplankton that would absorb CO2. They would also provide fresh water and support vegetation that could also suck up carbon.

Takeaways:

Not all offsets are created equal - removal offsets are far more effective than avoidance offsets

Corporate buyers should prioritize on reducing emissions where possible but also seek to buy carbon removal offsets over avoidance.

There are several different options in removal that vary in price and quality - corporates will likely take a portfolio approach to purchasing offsets (some cheap, some mid-range and some expensive ones).

We need more startups rapidly scaling carbon removal.

If you're someone looking to work on one of the most important problems of our generation with billions of dollars of upside, this is it. Reach out to me @lisawehden.

Thank you to Barnaby Lynch, Isha Mehra, Minn Kim, John Luttig, Karin Klein, Tevon Strand-Brown, Oliver Hsu, Max Shore, George Schmidbauer, Allister Furey for thoughts and feedback on this article.

Reading List:

https://www.scalingcarbonremoval.com/

https://www.givinggreen.earth/carbon-offsets-research/biochar

https://www.carbonbrief.org/beccs-the-story-of-climate-changes-saviour-technology

https://carbonplan.org/research/toucan-crypto-offsets

https://climatetechvc.substack.com/p/-giving-carbon-credit-where-its-due